This article was authored and originally posted by Ramparts. For any specific enquiries regarding the Gibraltar Gambling Bill 2025 discussed in this article, or if you require expert legal assistance with your gaming operations in Gibraltar, we encourage you to contact the Ramparts team directly, by reaching out to their Founder, Peter Howitt, author of this particular article or Head of Betting & Gaming, Andrew Tait.

1. Introduction

Gibraltar, a long-standing pillar of the global online gambling industry, is on the cusp of a significant regulatory transformation. The impending Gambling Act 2025, set to replace the Gambling Act 2005, introduces a modernised framework designed to reinforce the jurisdiction’s reputation, adapt to technological advancements, and align with evolving international standards.

For marketing service companies operating within or connected to Gibraltar’s vibrant gaming ecosystem, this new legislation brings compliance changes, most notably the explicit inclusion of marketing services as an activity licensable by the Gambling Division and the “sufficient substantive presence” test under Section 40.

Whilst this new licensing requirement adds costs and increased compliance burdens for marketing companies, the new requirements also help those companies to ensure they have a robust defensible presence in Gibraltar for VAT and other multi-national tax purposes.

This guide offers a strategic roadmap for marketing companies to proactively prepare and secure their future operations in Gibraltar.

2. The Shifting Sands: Why a New Regulatory Era?

The decision to overhaul the Gambling Act 2005, which has served Gibraltar for nearly two decades, stems from a clear recognition that the industry’s landscape has fundamentally changed. Technological innovation, the proliferation of online gambling, and heightened global scrutiny have necessitated a more robust and adaptive regulatory approach.

Gibraltar’s strategic objective is to maintain its competitive edge as a premier, reputable jurisdiction for gaming, particularly in the post-Brexit environment. This modernisation also directly addresses the need to ensure key legislation:

- Is fit for purpose given the changed regulatory and business landscape for online gambling

- Provides a full suite of enforcement options for the gambling regulator (which is also necessary given the focus of international bodies, such as the Financial Action Task Force – FATF);

- Enhances transparency and ensures that all licensed entities contribute genuinely to the local economy and operate within accepted international frameworks for regulated businesses

- Applies global economic substance principles, which aim to prevent artificial profit shifting and ensure that taxation occurs where genuine value is created.

A key aspect of this legislative evolution is the expansion of activities requiring a license. The new Bill explicitly brings “support services” to the gaming industry, including marketing, AML compliance, and other ancillary functions or group entities with a “Gibraltar touchpoint,” under direct regulatory scope.

This means that some marketing service companies that previously might have operated without a gambling license will now be required to obtain one. Subject to some very limited statutory exceptions, Gibraltar intends to regulate the entire value chain of the gambling industry. As noted by the Gibraltar Gambling Commissioner, Andrew Lyman, the purpose is to “widen the net to reduce [the] level of legitimate unregulated gambling services” .

3. The New Landscape: Key Requirements for Marketing Service Companies

For marketing service companies, two core elements of the new Bill demand immediate attention: the new licensable activity for marketing services and the “sufficient substantive presence” test.

Licensable Activity: Marketing Services Under the Spotlight

Under the new Gambling Bill, marketing services provided to gambling operators, whether directly or indirectly, from Gibraltar will now constitute a specific licensable activity. This broadens the regulatory scope significantly, imposing direct compliance obligations on a new category of businesses. This includes B2B support services licenses for software and technology providers. However, it’s important to note that if a Gibraltar licensed entity conducts proprietary marketing activity for its own business within the group in or from Gibraltar, a separate Gambling Operator’s Support Services license for marketing may not be required.

This change underscores the regulator’s commitment to a “common regulatory framework” similar to the Financial Services Act 2019, ensuring consistent standards across regulated economic activities.

The “Sufficient Substantive Presence” Test (Section 40): Building a Real Footprint

Central to the new Bill is the introduction of a “sufficient substantive presence” requirement, a fundamental criterion for both the initial grant and ongoing maintenance of a gambling license. This test is designed to ensure that licensed companies conduct genuine economic activity within Gibraltar, which mitigates the risk of companies seeking to establish in Gibraltar for legal registration purposes only (sometimes known as “brass plate” structure).

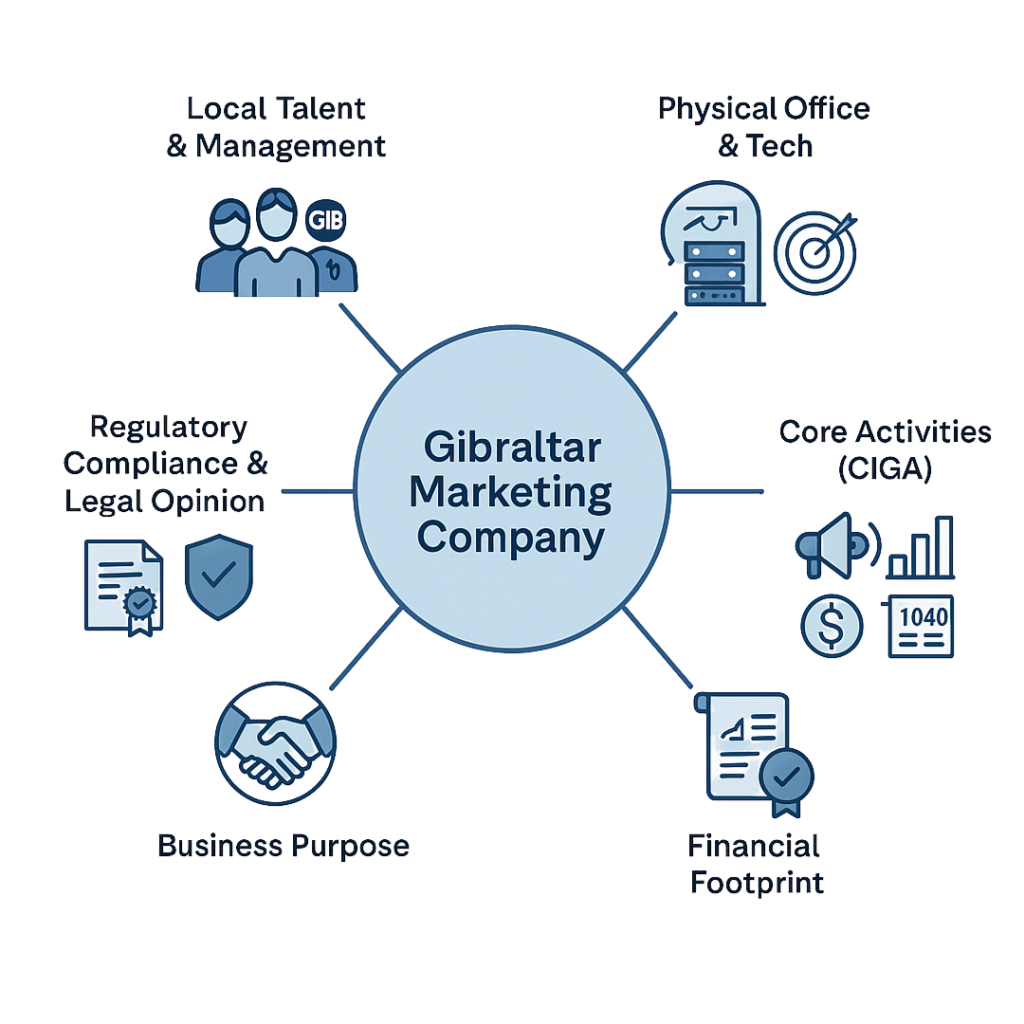

The Gibraltar authorities will consider several key factors when assessing a marketing company’s sufficient substantive presence:

- Human Resources: The company must demonstrate an “adequate number of appropriately experienced and, if appropriate, qualified full-time employees” physically present in Gibraltar including local directors. The number should be reasonable in proportion to the expected activities undertaken.

- Core Income-Generating Activities (CIGA): Employees should actively perform the CIGA related to the marketing function in Gibraltar. Crucially, the “mind and management” of the entity, meaning strategic decision-making authority, must demonstrably reside with Gibraltar-based personnel. This is further reinforced by the new “approved persons” regime, requiring key individuals (e.g., chief executives, financial officers, compliance heads) to be approved by the regulator.

- Physical Presence & Technical Resources: The marketing company must maintain “adequate physical assets or presence in the territory,” including an occupied physical office or premises genuinely utilised for operations.

- Financial Contribution: The entity must incur operating expenditure that is realistic and proportionate to its marketing activities in Gibraltar. The expected broad tax revenue is an explicit factor considered when assessing substance. Companies are also expected to explain the broader economic benefits they will bring to Gibraltar, such as employment and using local services.

- Commercial Rationale: All transactions and corporate structures must be underpinned by a genuine business purpose and demonstrate an economic effect beyond merely achieving a tax benefit. A comprehensive and credible business plan, outlining the long-term strategy and activities of the Gibraltar operation, is a mandatory requirement for licensing.

4. The Benefits of Licensing for Marketing Companies – the Alignment of Regulatory and Tax Substance

Regulatory bodies, like the Gibraltar Gambling Commissioner, and tax authorities, such as HMRC in the UK, Skatteverket in Sweden and other European tax authorities, are focused on economic reality over mere legal form. They want to ensure that a company’s stated activities and location genuinely reflect where value is created and where decisions are made.

The codification of a “sufficient substantive presence” test under Section 40, which includes requirements for human resources, physical presence, core income-generating activities (CIGA), and local management control aligns directly with the principles of economic substance that tax authorities apply when scrutinising cross-border arrangements.

Maintaining a robust and defensible multi-national group structure is crucial to ensure that the applicable corporation tax and VAT applicable to group wide activities are as planned.

5. Understanding the cross-border VAT issues

Under the EU VAT Directive and most national VAT laws (e.g. UK VAT Act 1994), the place of supply for B2B services is where the recipient is established (Article 44 of the VAT Directive). To qualify as the recipient, the entity must:

- Contract for the services in its own name,

- Pay for the services,

- Benefit economically from the services, and

- Use the services in the context of its own economic activity.

These criteria are discussed in case law, especially from the CJEU (Court of Justice of the European Union), which remains persuasive even in post-Brexit UK VAT cases.

| Case | Jurisdiction | Principle |

| DFDS (C-260/95) | CJEU | An agent acting with sufficient resources and exclusivity could be treated as a fixed establishment of a foreign company. |

| Newey v HMRC (UKFTT 618 (TC) | UK FTT applying CJEU principles | Substance over form: Businesses using offshore entities or intermediaries to route supplies in ways that don’t reflect actual activities or control risk those structures being ignored for VAT purposes. A key test is who bears the risk, who controls the service provision, and who actually performs the core functions. |

| Planzer (C-73/06) | CJEU | The recipient must have real economic and physical substance, not just a formal address. A company must register for VAT in the country where its effective management and business operations are located, not necessarily where it is incorporated. |

| Aro Lease (C-190/95) | CJEU | VAT treatment is based on objective reality. A business can recover VAT if it genuinely used the input in taxable activity and carried the burden of the cost. |

6. Principal vs Agent Categorisation

The principal vs agent distinction is crucial for VAT, contract law, and transfer pricing. In VAT law especially, it determines who is supplying and receiving services, and therefore who accounts for VAT.

A principal is the person who contracts and acts in their own name, taking on the risks, obligations and benefits of a supply. A principal will typically control key variables such as marketing strategy and budgets, the choice of third-party suppliers, and the substance of the services being delivered. They are treated as the supplier or recipient for VAT.

An agent is a person who acts on behalf of the principal, typically without taking legal or economic control of the supply and so it only provides an intermediary service for VAT (e.g. the relevant VAT is on its commission for intermediation and not the underlying supply).

If a marketing company is recharacterised as an agent then the place of supply of the marketing services is determined by the location of the real recipient (e.g. the UK/EU group affiliate). The appropriate VAT attribution reverts to the UK/EU group companies acting as principals.

7. Use & Enjoyment & Reverse Charge Mechanisms

Marketing purchases can give rise to VAT in a European or UK country even if the supplier or invoice addressee (customer) is outside the EU or UK, if the services are used and enjoyed in the UK or EU. Under use and enjoyment rules, VAT may be due where the service is effectively consumed — for example, local TV or radio advertising or sponsorship of a local sporting event.

In addition, when marketing services are supplied from a third country like Gibraltar to a UK or EU group company, the reverse charge rules can apply. These rules shift the obligation to account for VAT from the supplier (e.g., a Gibraltar company) to the recipient business in the UK/EU.

For fully taxable businesses, the reverse charge mechanism is typically VAT-neutral, as they account for both input and output VAT on their activities (and can usually deduct input VAT). However, in the UK and most EU countries, betting, gaming, and lottery services are VAT-exempt. As a result, many gaming operators cannot recover VAT incurred under the reverse charge mechanism because they do not themselves make VAT taxable supplies.

Multi-national groups also often make use of a non-EU intellectual property owner (e.g., a BVI, Cayman, or Gibraltar company – IPCo) that holds brand rights, and licenses those brands in return for royalties (inc. to UK/EU group companies). These IPCos also need to have sufficient substance and economic reality from a tax compliance perspective. The VAT treatment of these complex group arrangements needs very careful consideration, especially given reverse-charge rules and the VAT treatment of gambling services.

8. Licence Application Legal/Tax Opinion

Given the complexities of cross-border tax analysis and the new “sufficient substantive presence” test under Section 40, obtaining a formal legal and tax opinion becomes a crucial step to ensuring your application will be approved. The Gibraltar Gambling Division will require applicants to demonstrate that they meet these new requirements.

This process elevates the compliance burden from internal self-assessment to a more formal, external validation process. The legal opinion serves as an independent, professional assessment of whether the marketing company genuinely meets the specified substance criteria based on its specific operational facts, financial structure, and intercompany arrangements.

Whilst any specific content requirements will be subject to a scoping exercise and consultation with the Gambling Commissioner, a comprehensive legal opinion would typically cover:

- Legal Structure and Economic Alignment: Analysis of the company’s legal structure and its alignment with the economic reality of its Gibraltar operations.

- Functional Analysis: A detailed functional analysis of marketing services performed in Gibraltar, including the application of OECD DEMPE (Development, Enhancement, Maintenance, Protection, and Exploitation) functions where relevant to marketing intangibles.

- Human Capital and Management Control: Assessment of the adequacy and experience of local employees, and evidence of local “mind and management.”

- Physical Assets and Operational Infrastructure: Verification of the existence and adequacy of physical office space and key technical equipment.

- Financial Contribution and Expenditure: Review of the company’s financial contributions and proportionate operating expenditures in Gibraltar.

- Arm’s Length Pricing: Confirmation that intercompany marketing services are priced at arm’s length, supported by appropriate transfer pricing documentation.

- Intercompany Agreements: Evaluation of the legal soundness and consistency of intercompany agreements with substance requirements.

The credibility of this legal opinion will depend on the independence and specialised expertise of the advising legal firm.

9. The Wheel of Substance

10. How Gibraltar’s Licensing Requirements Strengthen International Tax Compliance

In meeting Gibraltar’s stringent regulatory requirements for substance, marketing companies are simultaneously building a strong defense against potential tax challenges from other countries. The regulatory imperative also provides a compelling non-tax reason for the structure. The detailed evidence of substance directly addresses the concerns of tax authorities regarding genuine economic activity and proper cross-border tax treatment.

However, it is crucial to remember that while the Gibraltar license and substance requirements provide a strong foundation, the reality of the actual day-to-day operations and consistent adherence to the documented arrangements remain of paramount importance. Tax authorities could still challenge any disconnect between the legal form, regulatory compliance, and operational reality.

- Demonstrable Commercial/Regulatory Purpose (The “Motive Test”):

- The regulatory requirement for oversight of marketing companies in Gibraltar and the requirement to establish and maintain significant substance in Gibraltar helps to defend claims that the primary motive for the arrangement is tax optimisation.

- When challenged by tax authorities in other countries, the company can assert substantial presence in Gibraltar and note that it is a direct consequence of a mandatory regulatory requirement to operate legally in the gambling sector.

- This is a powerful defense as it shifts the focus from a potential tax avoidance motive and any claim of artificiality of structure to a genuine business and regulatory imperative.

- Evidence of Genuine Economic Activity:

- The detailed requirements for human resources (qualified local employees, local directors i.e. “mind and management” in Gibraltar), physical presence (occupied office, key equipment), and proportionate operating expenditure provide concrete evidence of genuine economic activity in Gibraltar.

- This can help to counter arguments from other tax authorities that the Gibraltar entity is a “shell company” or lacks the capacity to genuinely perform its functions as a principal purchaser of marketing services.

- Defending Against Fixed Establishment Claims:

- A key challenge in VAT analysis is whether a foreign entity has a “fixed establishment” in that other country (having sufficient human and technical resources there) or whether it is in fact established in a different country for VAT purposes.

- If the Gibraltar marketing company has demonstrably robust resources in Gibraltar (as required by its license), it becomes significantly harder for other tax authorities to argue that the actual place of supply or consumption of services is in their jurisdiction because the Gibraltar entity lacks substance in its home territory.

- The Berlin Chemie case, for instance, focused on whether a subsidiary had sufficient resources to ensure it (and not the foreign German parent company) had a fixed establishment in Romania. While Berlin Chemie confirms that a subsidiary does not automatically constitute a fixed establishment of a foreign parent, cases such as Skandia (C-7/13) and Danske Bank (C-812/19) show that VAT fixed establishments can still arise in cross-border intra-group arrangements. These cases highlight that, even within the same legal entity, services between a head office and a branch can be subject to VAT if the branch forms part of a local VAT group or is treated as a distinct taxable entity.

- By mandating and verifying substance in Gibraltar, the new Act helps to solidify the argument that the Gibraltar entity is the true supplier or consumer of the marketing services supplied or purchased in and from Gibraltar.

- Clarity on Principal vs. Agent Roles:

- The licensing process and the requirement for a legal opinion on substance will compel marketing companies to clearly define their operational model, including a review of whether they act as a principal or an agent in their various activities.

- This clarity, backed by regulatory approval and a legal opinion, provides strong evidence to VAT authorities in other countries regarding the correct place of supply and the application of VAT rules for intercompany services. Mischaracterisation of these roles is a common VAT audit red flag.

- Enhanced Documentation and Credibility:

- The requirement for a legal opinion on substance and the comprehensive documentation required for licensing provide a robust audit trail and an opportunity to remedy any outstanding deficiencies.

- This externally validated and detailed documentation significantly strengthens the company’s position when facing scrutiny from tax authorities in other jurisdictions, as it demonstrates transparency and a genuine commitment to compliance.

11. Preparing for Compliance: A Strategic Roadmap

Proactive preparation is paramount for marketing companies to successfully navigate Gibraltar’s new regulatory environment.

Re-evaluating Your Operational Model

- Functional Analysis and DEMPE: Conduct a thorough functional analysis to identify the functions performed, assets employed, and risks assumed by your Gibraltar entity. For marketing intangibles (e.g., brands, proprietary methodologies), apply the OECD’s DEMPE framework. This involves demonstrating that the Gibraltar entity actively performs significant DEMPE functions, such as designing global marketing strategies, controlling marketing budgets, or managing brand reputation from Gibraltar.This ensures that value creation aligns with profit allocation, a key principle for tax authorities.

- Principal vs. Agent Clarity: Critically assess whether your Gibraltar entity acts as a principal or an agent for VAT purposes in its various marketing related activities. This distinction is crucial for determining VAT liabilities and avoiding mischaracterisation, which is a significant audit risk. Key indicators include commercial roles and responsibilities, legal liability, influence on pricing, how the entity holds itself out to third parties, and whether it adds significant value to the service.

- Language choice: Be careful if using terms like “procurement” as this could undermine a principal argument in VAT or transfer pricing audits and suggest an agency arrangement. The focus should be on marketing services and marketing strategy.

Strengthening Your Gibraltar Footprint

- Human Resources Enhancement: Ensure your Gibraltar entity has or will have an adequate number of appropriately qualified and experienced full-time employees who actively perform the core income-generating activities (CIGA) related to strategic marketing and brand services procurement. This includes demonstrating genuine decision-making authority and control over key functions.

- Human and technical resources group sharing arrangements: Consider arrangements that are in place to share human and technical resources between companies and clarify that sufficient resources will be under the control of the Gibraltar company.

- Physical and Technical Infrastructure: Secure and actively utilise adequate office space in Gibraltar. While some flexibility exists, ensure key technical equipment is either located in Gibraltar when required or its usage and contribution to Gibraltar-based activities are clearly justified.

- Financial Projections and Contribution: Develop a robust business plan with realistic financial projections for your Gibraltar operations. Clearly articulate the economic benefits your entity brings to Gibraltar, such as job creation, utilisation of local services, and tax revenue paid.

Mastering Intercompany Agreements and Documentation

- Drafting Robust Intercompany Agreements (ICAs): ICAs are the strategic backbone of transfer pricing compliance and risk management. They must be clear, precise, and legally binding, explicitly defining:

- Parties Involved: Full legal names, registration numbers, registered and trading addresses of all entities.

- Detailed Transaction Description: Precise explanation of marketing services, including scope, quality standards, and deliverables.

- Pricing Terms: Clear methodology for calculating prices, ensuring adherence to the arm’s length principle, supported by benchmarking studies as deemed necessary.

- Roles, Responsibilities & Risks: Explicit delineation of each entity’s functions, assets, and risks, ensuring alignment with economic substance. Misalignments are major audit red flags.

- Contemporaneous Documentation: Agreements should be signed before transactions occur and financial reporting takes place. Regularly review and update ICAs to reflect changes in business operations, tax laws, or market conditions.

- Audit Trail and Consistency: Maintain comprehensive records of all intercompany transactions, including invoices and financial flows. Ensure consistency between financial records, operational practices, and VAT returns. Discrepancies can trigger audits.

12. Navigating the Licensing Process

Obtaining a gambling license in Gibraltar is a rigorous process, typically taking between 4 – 6 months for B2C and B2B betting and gaming licences, depending on the quality of the application and supporting documentation. However, marketing companies and other support businesses licensable under the Act should be able to obtain a licence more quickly given the reduced compliance burden (e.g. AML/CTF/CPF, responsible gambling and safeguarding of customer funds may not be as relevant) and more limited operational requirements.

- Pre-licensing Engagement: It is highly recommended to engage with the Gibraltar Gambling Division and the Gambling Commissioner early in the process. This pre-licensing stage allows for an initial assessment of your company’s suitability and competence, helping to build a high-quality application that meets regulatory expectations.

- Application Requirements: Key application documents typically include:

- Proof of business reputation and financial solvency.

- A detailed and feasible business plan.

- Due diligence information on owners, founders, and directors, demonstrating impeccable reputation and experience in the gambling industry.

- Evidence of technical robustness and secure systems to ensure data protection and, where applicable, fair gaming practices.

13. Conclusion Protecting your Gibraltar Operations

The new Gibraltar Gambling Bill marks a significant evolution in the jurisdiction’s regulatory landscape, particularly for marketing service companies. The explicit licensing requirement and the stringent “sufficient substantive presence” test underscore a clear commitment to genuine economic activity and robust compliance.

For marketing companies, success in this new era depends on demonstrating the true economic substance of your operations in Gibraltar. By strengthening your human capital, optimising physical and technical infrastructure, articulating a clear commercial rationale, and meticulously documenting all intercompany arrangements, you can build a defensible position that withstands scrutiny by the regulator and tax authorities.

This is not a one-time compliance exercise but an ongoing commitment. Continuous monitoring, adaptation to evolving regulatory standards, and a willingness to seek expert legal and tax advice will be crucial for mitigating risks, enhancing your company’s reputation, and ensuring sustained operational continuity in Gibraltar’s dynamic gambling market. Embracing these changes will position your company for long-term success in a highly regulated but supportive jurisdiction.